2024 EV Tax Credit

Maximize Your Savings: A Guide to the 2024 Ford EV Tax Credit Benefits

If you’re considering a Ford electric vehicle, understanding the 2024 Ford EV tax credit is essential. This article strips down the hype to what you actually need to know—how to qualify for the tax credit, how much you could save, and the specific Ford models that are eligible for up to $7,500 in savings.

Understanding the 2024 Ford EV Tax Credit

- The 2024 Ford EV tax credit is a nonrefundable tax credit of up to $7,500 for qualifying electric or plug-in hybrid vehicle purchases

- For vehicles that don't meet full criteria, a partial credit of $3,750 is available, with the total credit consisting of two separate credits, each worth $3,750.

- Eligibility for the full $7,500 tax credit or a portion of it depends on meeting battery capacity and sourcing requirements.

- Tax credits also extend to the used EV market with up to $4,000 credit for cars under $25,000, while additional state and local incentives, as well as specific benefits for commercial vehicle tax credits, are available to further support EV adoption.

- To qualify, the vehicle must be manufactured in North America and have an MSRP below $55,000 for sedans or $80,000 for SUVs

- Customers can verify if an electric vehicle is eligible for the tax credit by checking the current list on the Customers can verify if an electric vehicle is eligible for the tax credit by checking the current list on the FuelEconomy.gov website or by assuring the vehicle identification number (VIN) qualifies.FuelEconomy.gov website or by assuring the vehicle identification number (VIN) qualifies.

Understanding the 2024 Ford EV Tax Credit

Embarking on a greener journey is now more attractive with the 2024 Ford electric vehicle tax credit. This nonrefundable incentive allows buyers of eligible electric or plug-in hybrid vehicles to shave up to $7,500 off their purchase. The precise amount of this EV tax benefit depends on both the power capacity of the battery and the origin of its components. Purchasers can tap into two portions worth up to $3,750 each that could combine for the maximum value.

To be in line for this federal EV tax credit, there are specific criteria your vehicle must meet: it has to be manufactured within North America and come under certain price ceilings – not exceeding $55,000 if it’s a sedan or $80,000 if an SUV is what you’re eyeing. For reassurance that your chosen model qualifies for these advantages prior purchasing one, simply verify through FuelEconomy.gov or utilize VIN verification methods which will tell whether your potential new set wheels complies with all required standards.

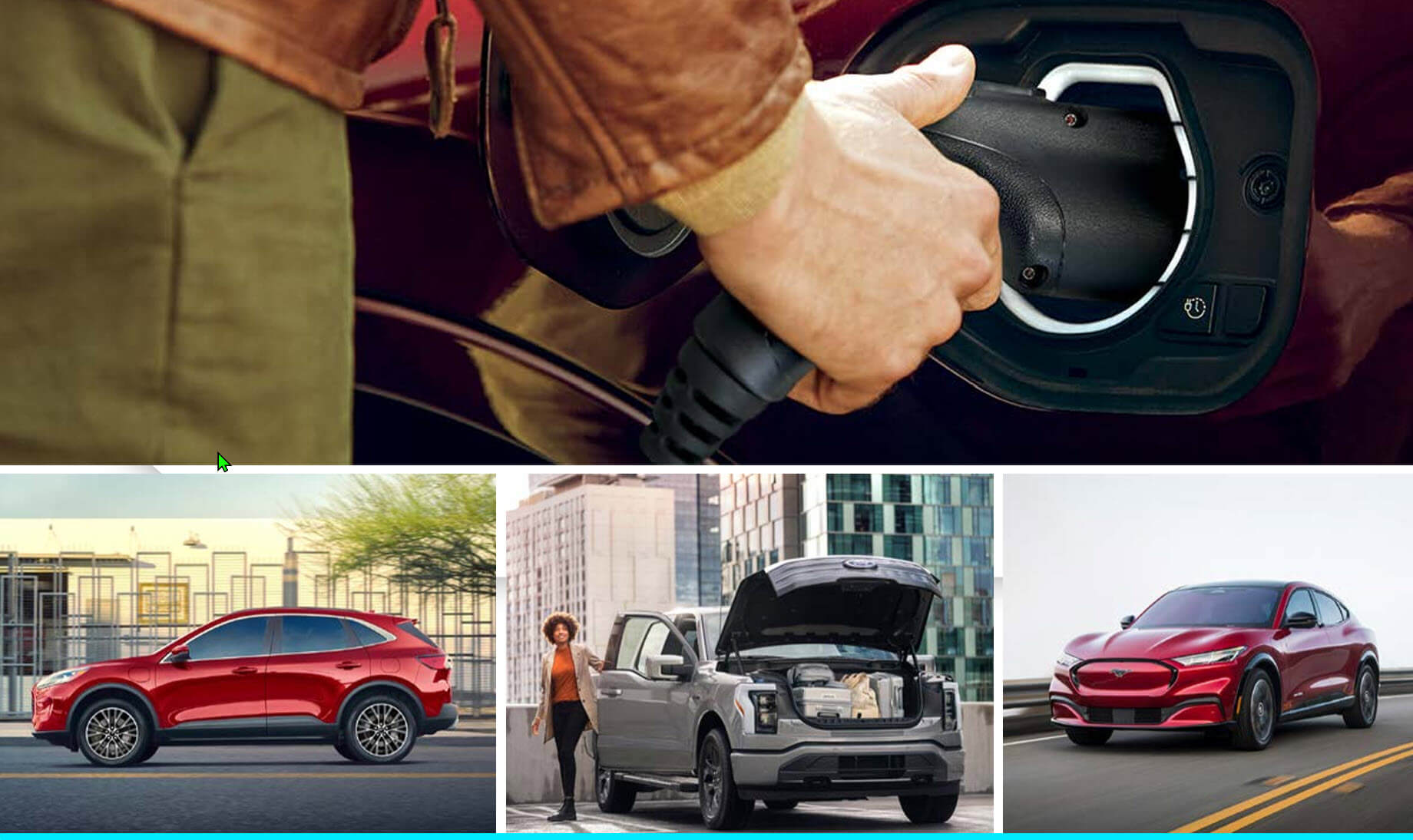

Eligible Ford Models

Not every vehicle is eligible for the same benefits, as demonstrated by the formidable electric Ford F-150 Lightning, which stands out with its qualification for the entire $7,500 tax credit. Snagging this full sum requires that vehicles like the F-150 Lightning adhere to strict requirements related to critical minerals and battery components. Car buyers should engage dealers in conversation about these nuances because not all models or configurations may be eligible for the tax incentive.

The prominent position of the F-150 Lightning within Ford’s lineup of electric vehicles is shared by others such as the Mustang Mach-E when it comes to eligibility for a tax credit. Yet, car enthusiasts must remain vigilant. The roster of qualifying models is subject to change with potential additions or exclusions over time. Those on the hunt for new wheels need to stay informed about whether their preferred choice remains listed under those granted this financial perk.

Income Limits and Price Caps

The tax credit for electric vehicles is designed to be within reach of a diverse group of electric car buyers, with particular income parameters in place. In detail:

- Married couples who file taxes jointly need a modified adjusted gross income under $300,000

- Heads of household and single filers are set at limits of $225,000 and $150,000 respectively

- The manufacturer’s suggested retail price (MSRP) should not exceed $80,000 for new vans, SUVs, and pickup trucks

- For sedans and other types of passenger cars the MSRP cap is established at $55,000

These financial criteria prevent high-end electric vehicle purchases from qualifying for the tax credit.

In an effort to level the playing field even and encourage EV adoption among middle-income earners in America, these rules have been instituted. There is good news for those interested in pre-owned vehicles: used electric cars come with their own maximum price limit set at $25,000, which also allows potential savings through partial tax credits.

The Ford F-150 Lightning: A Closer Look

The buzz surrounding the Ford F-150 Lightning is well-deserved. This electric powerhouse isn’t merely about quiet strength. It represents a fusion of immense power with environmental consciousness. The Extended Range Battery powers this beast, allowing it to pump out an impressive 580 horsepower and 775 lb.-ft. of torque — hallmarks of a new era in performance vehicles. Feel your heart race as you witness its capability to:

- Accelerate from zero to 60 mph in under four thrilling seconds

- Traverse up to 300 miles on just one charge

- Offer expansive comfort within its cabin alongside cutting-edge technology

- Facilitate convenient charging whether at home or elsewhere

All achieved with minimal environmental impact.

Refueling energy into the F-150 Lightning’s batteries is hassle-free thanks to its substantial battery capacity at 131 kilowatt-hours that promises long-lasting journeys without frequent stops for recharging. When recharge time arrives, drivers can take advantage of swift charging times—restoring battery levels from 15% all the way up to 80% takes only around 41 minutes—allowing them not miss a beat in their busy lives.

Claiming the EV Tax Credit: Step-by-Step Guide

Embark on the quest for your EV tax credit by first verifying that your newly acquired electric vehicle is within the scope of eligibility criteria and that your earnings do not exceed threshold levels – a swift check with your car dealer can help ensure this.

Then, equip yourself with all vital documentation, like the bill of sale and IRS Form 8936. This preparation will navigate you smoothly toward fiscal benefits without unnecessary hiccups.

As the time to settle accounts with Uncle Sam approaches, present IRS Form 8936 alongside your federal tax return during tax season for the year in which you took possession of your electric vehicle. Keep in mind though: while this clean vehicle tax credit diminishes what you owe to the government, it’s nonrefundable. Excess amounts won’t come back as part of a refund nor carry over into future years.

Dealership Rebate Option

Some dealerships offer the EV tax credit as an upfront discount at the time of purchase, allowing for immediate savings which is highly appealing for those looking to reduce their out-of-pocket expenses. These participating dealerships have registered through the IRS Energy Credits Online portal, which enables them to deduct up to $7,500 from your sales price by verifying vehicle specifics and the eligible tax credit amount. It’s important to note that not every dealership offers this benefit – verify whether your preferred dealership provides this direct reduction on price.

Reach out to the Gresham Ford Sales and Leasing team to confirm the availability of upfront discounts.

When opting for this advance application of the ev tax credit, ensure that your dealership has completed a seller report with the IRS in order to officially transfer the credit. This process effectively reduces the sale price right away and puts money back into your wallet immediately upon purchasing.

State and Local Incentives

There are many state and local perks on top of the federal advantages. States such as California and New York augment these incentives with their own rebates, providing an added incentive beyond the existing federal tax credit for electric vehicles. In California, being an EV driver can also grant you privileged use of carpool lanes, which is a significant advantage in heavy traffic situations.

The encouragement to switch to EVs isn’t limited to the cars themselves. It includes support for related infrastructure too. A variety of incentives promote the setting up of EV charging stations, thereby making recharging more convenient for those who drive electric vehicles. Collaborative efforts like those outlined in the Regional Electric Vehicle (REV) West Plan show how states are working together towards creating a unified framework that supports widespread adoption of electric vehicles across different jurisdictions.

Leasing and Commercial Vehicle Tax Credits

When considering leasing or acquiring commercial vehicles, it’s wise to examine the implications of tax credit incentives. Vehicle manufacturers may incorporate the federal tax credit into lease agreements with terms like ‘EV Lease Bonus’ or ‘lease cash.’’ Such deals can substantially reduce your monthly outlay. It is prudent to assess all financial aspects including these tax credits as well as future resale value.

Companies benefit from a more generous commercial vehicle tax credit which extends up to $7,500 for smaller light-duty vehicles and escalates to $40,000 for heavier models used in business operations. This particular incentive comes with less stringent conditions compared to its consumer counterpart. Firms cannot claim both this special commercial use-based allowance and the standard clean vehicle incentive on the same automobile.

Impact of Battery Sourcing Requirements

The introduction of the tax credit is sending shockwaves through the industry due to its stringent battery sourcing stipulations. Electric vehicles must be assembled in North America and a substantial part of their battery components, as well as critical minerals, need to originate from either the United States or its free trade allies. This change is designed to strengthen local supply chains and increase job opportunities, even though it initially limits the number of qualifying electric cars.

These rigorous requirements are intended to diminish reliance on foreign sources for materials, particularly with countries such as China being major suppliers currently. As car manufacturers work towards realigning their production processes according to these new rules, we can expect an expansion in available new electric vehicles that meet these conditions — hence decreasing dependence on cars powered by traditional fossil fuels.

Used EV Tax Credit Benefits

Purchasing used electric vehicles presents numerous opportunities for tax incentives as well. Buyers who qualify may deduct up to $4,000 on their purchase of a pre-owned EV that costs less than $25,000—this initiative aims to democratize eco-friendly transportation options. What’s more, individuals can benefit from this deduction immediately at the time of purchase instead of waiting until filing their tax return if they don’t owe any taxes.

There are certain qualifications that these secondhand electric vehicles must meet in order for buyers to enjoy the electric tax credit.

- They should have a minimum battery capacity of 7kWh.

- The sale needs to occur through an authorized dealer.

- Prospective owners must earn below designated income caps.

- Claimants should not have received a used EV tax credit within the past three years.

- These automobiles shouldn’t be bought with intent for immediate resale purposes.

- The purchaser cannot be listed as dependent on someone else’s tax documents.

Navigating the EV Market in 2024

To navigate the 2024 EV market, one must stay abreast of the latest industry trends and tax credit updates. As automakers ramp up their compliance with new battery and mineral supply chain requirements, the list of eligible EVs for tax credits is anticipated to expand. Keeping a pulse on these changes is crucial for anyone looking to make a well-informed electric vehicle purchase.

Being informed and flexible is essential for capitalizing on the best opportunities. Whether it’s keeping tabs on eligible vehicles or staying abreast of policy shifts, a strategic approach can lead to significant savings and a smoother transition to electric driving.

.

More Info

To sum up, the 2024 Ford EV Tax Credit Benefits offer a substantial financial boost for both new and used EV buyers. By understanding eligible models, income limits, and price caps, you can navigate the tax credit landscape with confidence. The Ford F-150 Lightning stands out as a prime example of an electric vehicle that not only offers thrilling performance but also qualifies for the full $7,500 tax credit, provided it meets stringent battery sourcing requirements.

As the industry evolves and the list of eligible vehicles grows, staying informed remains critical. It’s a dynamic time for electric mobility, and with the right knowledge, you can maximize your savings and contribute to a cleaner, more sustainable future. Embrace the potential of electric vehicles and the financial incentives they bring – it’s an investment in both your wallet and the world.

Frequently Asked Questions

Can I get the EV tax credit if I lease an electric vehicle?

If you opt to lease an electric vehicle rather than purchase one, you’re unable to directly claim the EV tax credit. It’s possible to reap some benefits from this incentive indirectly through discounts offered by dealers.

Are any used EVs eligible for the tax credit?

Certainly, pre-owned electric vehicles are eligible for a tax credit up to $4,000 provided they satisfy certain conditions. Eligibility hinges on various aspects like income thresholds, the age of the vehicle, battery capacity criteria and whether it is purchased through a certified dealership.

How do battery sourcing requirements affect EV tax credit eligibility?

Initially, the 2024 EV tax credit comes with more stringent requirements for battery sourcing and assembly, which means a smaller selection of models will qualify. Yet, it is expected that as manufacturers adjust to these conditions, the roster of eligible electric vehicles for the tax credit will grow.

Can the EV tax credit be claimed for vehicles priced over the MSRP limit?

The tax credit for electric vehicles, known as the EV tax credit, is not applicable to cars that exceed certain price thresholds. These thresholds include a maximum manufacturer’s suggested retail price (MSRP) of $55,000 for sedans and $80,000 for sports utility vehicles (SUVs) and pickup trucks. There’s a cap of $25,000 on used vehicles when it comes to claiming this particular tax incentive.

How can I verify if a Ford model is eligible for the EV tax credit?

To ascertain whether a Ford model qualifies for the EV tax credit, consult the latest list at FuelEconomy.gov or authenticate if the vehicle identification number (VIN) is eligible. Employ either of these strategies to confirm that your vehicle meets the requirements for obtaining the tax credit.